1099-K, 1099-NEC, and 1099-MISC Rules for 2025 & 2026 What Changed, Why It Matters, and the Smart Way to Stay Compliant

If it feels like the IRS keeps changing the rules around 1099 reporting, you’re not imagining it. Over the last several years, thresholds have been announced, delayed, phased in, and then adjusted again by legislation — often late in the year.

That’s exactly why understanding how the system works matters more than memorizing a dollar amount.

Let’s walk through:

how we got here

what the current thresholds are for 2025 and 2026

why this matters now (especially for contractors)

and how to protect yourself even if the rules change again

First: What Is a 1099-K?

A 1099-K is an informational tax form issued by third-party payment processors — not by you.

It reports gross payments processed on your behalf through platforms that facilitate transactions and charge processing fees, such as:

credit card processors

Stripe

Square

PayPal business accounts

Venmo business accounts

A 1099-K does not determine what you owe in taxes. It’s a reporting tool the IRS uses to match income reported on tax returns.

How 1099-K Thresholds Have Changed Over Time

This is where most confusion comes from.

Before 2022

1099-K reporting only applied if both were true:

More than $20,000 in gross payments and

More than 200 transactions

2021–2023

The IRS announced a drop to $600, then delayed enforcement multiple times due to widespread confusion and pushback.

What Changed Again

Recent legislation reversed the phased-in $600 plan and restored the original federal threshold for 1099-K reporting.

1099-K Reporting Thresholds (Current Federal Rules)

For 2025 and 2026 (Payments You Receive)

At the federal level, a third-party payment processor is generally required to issue a 1099-K only if both are met:

More than $20,000 in gross payments and

More than 200 transactions

This applies to payments received, not payments you make.

⚠️ Important notes:

Some processors may issue 1099-Ks voluntarily

State-level reporting rules may differ

Gross receipts are reported, not profit

A 1099-K Does Not Create New Tax

This is worth saying plainly:

A 1099-K does not mean you owe more tax.

You are still taxed on net income, after deductible business expenses.

The form exists so the IRS can match reported income — not to calculate your tax bill.

Now the Part That Matters Most: Contractors & Double Reporting

When the 1099-K threshold was high, this distinction didn’t matter much. Most contractors never received a 1099-K, so even if a business owner reported incorrectly, the IRS didn’t see duplicate information.

That safety buffer is shrinking — not because of 1099-K alone, but because contractor reporting rules are changing too.

1099-NEC and 1099-MISC Thresholds (Payments You Make)

For Payments Made in 2025

$600 or more → 1099-NEC or 1099-MISC required

Applies to payments made by:

check

cash

Zelle

ACH

debit card

For Payments Made in 2026

Threshold increases to $2,000

The IRS has indicated this amount will be indexed for inflation going forward

Why Payment Method Matters (and Where Double Reporting Happens)

Here’s the rule that prevents problems:

If you pay a contractor through a third-party payment processor that charges a fee

➡️ Do not issue a 1099-NEC for those payments

Why? Because if:

the processor issues a 1099-K and

you issue a 1099-NEC for the same income

the IRS now sees two forms reporting the same money.

That can lead to:

income mismatches

confused contractors

IRS notices that take time to resolve

This wasn’t a big issue under the old system. It is now.

The Reality Check: These Rules Can Change Again

History tells us this clearly — 1099 rules are not immune to last-minute changes. Thresholds have moved more than once, sometimes late in the year.

That’s why the smartest approach isn’t chasing numbers. It’s building a system that holds up even if the rules shift again.

The Safe Play (No Matter What Changes)

If you want to stay compliant and sane:

1. Get the W-9 Upfront

Always. Even if you think you won’t need it.

2. Track All Contractor Payments

Tracking does not equal reporting — it gives you flexibility and protection.

3. Pay Contractors Through One Payment Source

This is the biggest simplifier.

Using one third-party processor:

reduces reporting errors

limits double reporting risk

makes year-end compliance cleaner

Consistency beats complexity every time.

The Bottom Line

Here’s what applies right now at the federal level:

1099-K: $20,000 and 200 transactions

1099-NEC / 1099-MISC (2025): $600

1099-NEC / 1099-MISC (2026): $2,000

But the real takeaway isn’t the numbers — it’s the system.

Get the W-9.

Track everything.

Pay contractors consistently.

Do that, and you’re protected even if the IRS changes the rules again.

Want This Done the Right Way (Without Guessing)?

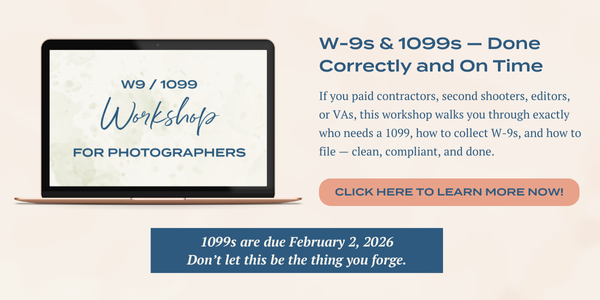

If reading this made you think, “Okay… I get it, but I don’t want to mess this up,” that’s exactly why I created the W-9 / 1099 Workshop.

Inside the workshop, we walk through everything you need to report contractor payments correctly, step by step — from determining who counts as a contractor, to collecting W-9s the right way, to filing 1099s without double reporting or missed forms. You’ll see real examples, common mistakes, and exactly how to apply these rules to a photography business specifically.

If you want clarity, confidence, and a clean system you can reuse every year, you’ll feel right at home here:

👉 Join the W-9 / 1099 Workshop

This pairs perfectly with the information in this post and gives you the practical “how” behind the rules.

References

IRS Guidance & Fact Sheets

IRS Fact Sheet FS-2025-08 (1099-K Reporting Updates & Threshold Clarifications)

https://www.irs.gov/pub/taxpros/fs-2025-08.pdf

Third-Party Professional Analysis (Legislative Changes)

Avalara — One Big Beautiful Bill Act: 1099 Reporting Threshold Changes

https://www.avalara.com/blog/en/north-america/2025/07/one-big-beautiful-bill-act-1099-reporting-threshold.htmlRSM US — IRS Updates to 1099 Reporting Thresholds

https://rsmus.com/insights/services/business-tax/irs-updates-obbba-new-reporting-thresholds.htmlOnPay — 1099 Reporting Threshold Updates

https://onpay.com/insights/1099-reporting-threshold-updates/