Get the Sales Tax Workshop for Photographers

Gain clarity, stay compliant, and skip the stress spiral

In just 45 minutes…

Get Sales Tax Set Up the Right Way

Everything you need distilled into a 45-minute workshop.

No fluff. No jargon.

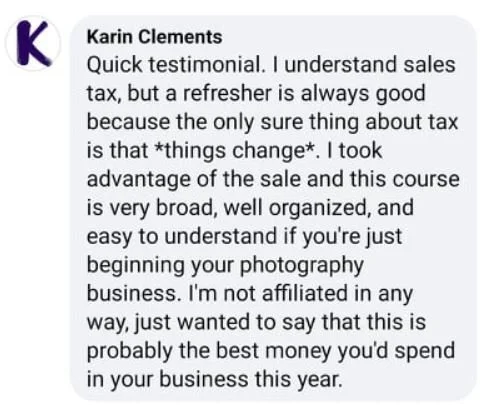

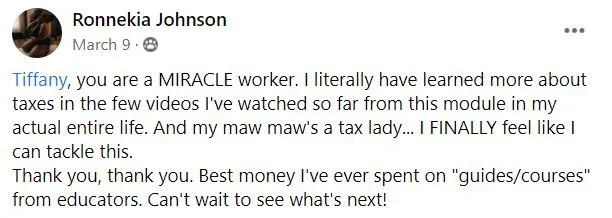

What photographers are saying:

Hard Truths About

Photography & Sales Tax

Here's what I've learned working exclusively with thousands of photographers -

Most photographers don't realize these sales tax realities:

You're not exempt just because you're creative. Sales tax impacts photographers in 45 states—even if you think you're "too small" or "just doing this part-time."

Digital doesn't mean "not taxable." Many states consider those gorgeous digital galleries just as taxable as physical products. More states are adding digital photography to their taxable list every year—yet photographers keep assuming online deliveries are tax-free! What was non-taxable last year might require collection this year.

Crossing state lines creates tax obligations. That destination wedding in Napa? That family reunion shoot in Florida? Each requires understanding completely different tax rules.

The responsibility falls on YOU, not your clients. If you fail to collect sales tax, the tax authorities won't chase your clients—they'll come directly to you for the money (plus penalties).

The penalties are no joke. I've seen photographers hit with $5,000+ in unexpected tax bills because they misunderstood what was taxable in their state. One wedding photographer had to use her entire emergency fund to cover penalties.

The most frustrating part?

The information you need is out there… but it’s buried in government websites written in legal jargon. It’s no wonder so many photographers feel unsure about whether they’re doing sales tax correctly — the systems are complicated on purpose.

let's face it-You probably didn't become a photographer to master tax law.

That’s exactly why I condensed everything you need to know about sales tax into a simple workshop that helps you get this set up the right way, today — no more putting it off.

I've Seen the Real Consequences of Sales Tax Confusion

Let me share some real stories from photographers I've worked with:

The Wedding Photographer's $8,500 Nightmare

One of my wedding photographer clients got blindsided with an $8,500 tax bill because she didn't realize digital galleries were taxable in her state. That's an entire season's profit—gone. She had to dip into her family's savings to cover it.

The Portrait Photographer Who Had to Cancel Her Gear Upgrade

A portrait photographer I work with had saved for months to upgrade her camera body. Then the tax notice came—$3,200 in penalties and back taxes for incorrectly handling sales tax. That new gear? Had to wait another year.

The Family Photographer Who Paid Twice

One of my family photographer clients had to pay over $5,000 out of her own pocket because she couldn't exactly call clients from 2-3 years ago and say, "Hey, remember those photos? I need more money for taxes I didn't charge." Talk about a double financial hit.

The Destination Wedding Photographer's Multi-State Mess

A destination wedding photographer found herself in compliance trouble in four different states because each had different rules. The final damage? Nearly $12,000 in back taxes, penalties, and professional fees to sort it all out.

These aren't rare horror stories—

they happen to real, talented photographers every day.

The worst part? None of these photographers were trying to cheat the system. They simply didn't understand the complex web of sales tax requirements that affect photography businesses.

It’s Not Your Fault,

But It Is Your Responsibility

Unfortunately…

The sales tax system is stacked against photographers like you

Tax codes were written by accountants, for accountants—not for photographers who are busy capturing beautiful memories

Each state has its own confusing rules about what's taxable (digital files? editing time? travel fees?)

Most photography courses teach you everything about light and composition, but nothing about sales tax compliance

The regulations keep changing, sometimes multiple times per year

Here's the brutal truth:

Sales tax is real, required, and enforced — even if no one taught you how it works. Tax authorities don’t send heads-up emails or friendly reminders. They simply expect you to know the rules for your state and follow them.

And if you’ve been running your business without registering, collecting, or filing correctly? You’re not alone — almost every photographer starts that way. Not because they’re irresponsible, but because this information isn’t explained anywhere in a way that makes sense.

You've worked too hard to build your photography business to lose it over something you can fix now

That’s exactly why I created this workshop — to take everything you need to know about sales tax and break it down into a simple, step-by-step process you can get set up today. Once you understand how your state works and what you’re responsible for, the anxiety disappears and the confidence kicks in.

In just 45 minutes with this workshop, you will transform tax confusion into complete clarity so you can finally focus on what you do best!

Introducing:

Sale Tax Workshop for Photographers

Hi, I'm Tiffany

I’m who photographers come to when they’re tired of Googling “sales tax help” and getting 17 different answers that all contradict each other.

I’m an IRS Enrolled Agent with an MBA in Accounting who works exclusively with photographers. Not real estate agents. Not restaurants. Not random small businesses. Just photographers — all day, every day.

After about my 500th conversation that went something like this:

Photographer: “Tiffany… I seriously have no idea if I should be charging tax on digital galleries in my state. Please help.”

Me: “Okay, let me look up your state’s rules real quick…”

I finally decided to stop having the same stressful conversation over and over and create something photographers could learn from once — and actually understand

How Your Business (and Life) Changes With This Workshop

Inside you’ll learn

✅ What Sales Tax Actually Is (for Photographers)

Finally understand what counts as taxable, what doesn’t, and why states care — in language that actually makes sense.

✅Which States You Owe Sales Tax In

We cover nexus, traveling for sessions, destination vs. origin states, and the rules that apply when shooting out of state.

✅ What’s Taxable in Your Business

Prints, albums, digital files, retainers, services — every state treats these differently. I show you how to know with certainty.

✅ How to Register the Right Way

The steps to get registered confidently

(even if you’ve been in business for years). No spiral. No guessing.

✅ How to Track, Charge & Collect Sales Tax

How to set this up cleanly inside your CRM, gallery platform, and accounting software — without overcomplicating anything.

✅ How to File & Remit Without Stress

What to include, how to read your tax return, which numbers matter, and how to avoid late fees or penalties.

✅ How to Handle the Messy Situations

What to do when clients cancel, reschedule, use gift cards, or when you need to refund a client or apply credits.

✅What to Do If You Haven’t Been Doing It Correctly

A shame-free plan to fix past mistakes, including how state amnesty (VDA) programs work and when to use them.

The Bottom Line:

By the end of this workshop, you’ll know exactly how sales tax works in your business — and you’ll be set up the right way moving forward.

Say goodbye to sales tax stress forever.💫

Instant Sales Tax Clarity For Your Photography Business ●

Instant Sales Tax Clarity For Your Photography Business ●

What’s Inside:

📸 Lesson 01 — What Is Sales Tax?

Understanding what sales tax actually is and why states require it.

🧭 Lesson 02 — Sales Tax Compliance

The 3-step decision framework to know exactly when you must collect sales tax.

📍 Lesson 03 — Sales Tax Nexus

How physical presence creates a tax responsibility (and what counts).

💻 Lesson 04 — Economic Nexus

When digital/remote sales trigger tax obligations — even if you never visit that state.

🧾 Lesson 05 — What’s Taxable?

Digital files, sessions, products — what your state actually taxes.

🏙 Lesson 06 — Sales Tax Rates

How to find the correct state + local rate every time.

✈️ Lesson 07 — Destination Shoots

The truth about shooting in other states and what that means for tax compliance.

⚠️ Lesson 08 — Failure to Register, File, or Pay

What happens if you haven’t been collecting or filing (and what to do now).Digital Images: Are your online galleries taxable? (Hint: In many states, YES!)

🤝 Lesson 09 — State Amnesty Programs (VDAs)

How photographers legally fix past issues without penalties.

🏷 Lesson 10 — Sales Tax Exemption

How to buy albums, prints, and products tax-free when you plan to resell them.

🔄 Lesson 11 — Entity Changes

What happens to your sales tax registration when you become an LLC or S-Corp.

🧯 Lesson 12 — Common Mistakes

The top missteps photographers make — and how to avoid them for good.

💸 Lesson 13 — Refunds

How to handle sales tax correctly when you issue a refund.

🎁 Lesson 14 — Gift Cards & Deposits

What’s taxable, what’s not, and how to record it properly.

🖥 Lesson 15 — Galleries & CRMs

How systems like Pic-Time, HoneyBook, and others handle sales tax.

📦 Lesson 16 — Packaging & Pricing

How to structure your packages so tax is simple, clean, and compliant.

The Moment Everything Changes

Picture this: You're creating a proposal for your dream client. Instead of that knot in your stomach when you get to the tax line, you confidently type in the exact amount, knowing it's 100% correct.

No more second-guessing yourself.

No more worrying if you're charging too much or too little.

No more fear that you'll get that dreaded letter from the tax authority.

Just the peace of mind that comes from absolute certainty about your tax obligations—and the confidence to explain them clearly to your clients.

This workshop doesn't just protect your business—it protects your peace of mind.

Section 15

Sound Familiar?

"Wait, do I need to charge tax on digital galleries?"

You've delivered hundreds of online galleries, but suddenly realized you have no idea if they're actually taxable in your state. (And the Google rabbit hole isn't helping.)

"What happens if I shoot a wedding in another state?"

Your photography business is growing, and now you're booking destination weddings. But does that mean you need to register for sales tax in every state you visit?

"Am I supposed to charge tax on my sitting fee? My travel costs? My albums?"

You've tried reading your state's tax website, but it might as well be written in ancient hieroglyphics for all the clarity it provides about photography businesses.

"What if I've been doing this wrong for years?"

That pit in your stomach when you realize you might have been handling sales tax incorrectly since you started your business—and have no idea what that could cost you.

If you nodded your head to ANY of these, you're exactly who I created this workshop for.

I've worked with thousands of photographers, from brand new side-hustlers to veteran studio owners, and these questions come up again and again.

The difference?

Some photographers keep guessing and hoping for the best (yikes!), while others attend the workshop to get crystal-clear answers and protect the business they've worked so hard to build.

Which photographer do you want to be?

Why I Created This Workshop For You

As an accountant who works exclusively with photographers, I've watched too many talented creatives get buried in sales tax confusion instead of building their dream business.

What Sales Tax Confusion Really Costs You:

⏱️ Lost Time

Those hours searching "photography sales tax" could be spent shooting, editing, or finding your next dream client. I've seen photographers waste entire weekends trying to decipher tax codes.

😴 Lost Sleep

That nagging uncertainty about whether you're charging correctly isn't just annoying—it's stealing your creative energy and peace of mind. Photography requires clarity and focus.

💰 Lost Money

Whether it's penalties for undercollection or refunds for overcollection, sales tax mistakes are expensive. I've helped photographers who faced $7,000+ in unexpected tax bills that could have been easily avoided.

🔮 Lost Opportunities

Every minute spent worrying about taxes is a minute you're not mastering new techniques, connecting with clients, or growing your business. Your talent deserves better.

Your Photography Deserves Your Full Attention

I built this workshop to take sales tax off your mental load once and for all,

so you can spend less time Googling and more time doing what you LOVE.

Your creativity is too valuable to waste on tax stress. Let’s handle this — and move on.

This small investment could save you thousands in penalties, hours of wasted research, and the constant stress of wondering if you’re doing this right. Put that time and money back where it belongs — into growing your business and creating work you’re proud of.

Take 45 minutes today and walk away knowing exactly how to register, charge, track, and pay sales tax — without sacrificing your creative energy.

I'm Not Your Parents' Accountant

Hi! I'm Tiffany Bastian—an IRS-certified Enrolled Agent with an MBA in accounting who exclusively serves photographers. Not photographers and other small businesses. Not photographers and some real estate agents. Just photographers.

Why Photography-Only?

Because I believe the best financial advice comes from someone who truly understands your industry inside and out. After 20+ years in accounting, I've developed a specialized expertise in the unique financial world photographers live in:

📸 I Understand Your Business Reality:

That expensive camera is both a business tool and something you'd buy anyway (let's navigate that tax line)

Your pricing isn't just about hours—it's about creativity, expertise, and image rights

Your income might be booming in May-October and crickets in January

Your business exists in a complicated web of state-to-state sales tax requirements

🗣️ I Speak Human, Not Accountant

You won't hear me saying things like "please reference section 179 of the tax code regarding depreciation schedules." I promise to never make you feel dumb for asking questions about your finances.

🤝 I'm On Your Team

My mission isn't just to keep you compliant—it's to help you build a legitimate, profitable photography business that supports the life you want. I'm the financial partner in your corner who gets what you're trying to build.

When photographers ask me for recommendations, I don't just point them to generic resources—I create exactly what they need. That's why this sales tax guide exists: because hundreds of talented photographers like you were struggling with the same problem, and deserved a better solution.

Don't Wait for the Audit Letter

Most photographers only address sales tax after:

➜ Receiving a penalty notice ➜ Getting audited by state authorities➜ Realizing they can't collect back taxes from past clientsStates are increasingly targeting photographers.

With more states adding digital images to taxable lists and cross-referencing business registrations, the risk grows every month you delay.

Avoid thousands in potential penalties tomorrow.

Frequently Asked Questions

-

States are getting more aggressive about auditing photographers, especially with digital products becoming taxable in more places. The longer you've operated without proper compliance, the bigger the bill when they catch up to you.

Real example: A wedding photographer I worked with got hit with $15,000+ in back taxes after 5 years of non-compliance. That's exponentially more than if she'd collected correctly from the start.

This workshop helps you protect everything you've built, no matter how long you've been in business.

-

This workshop is still essential because:

You'll get complete clarity on your home state's specific requirements

You'll be prepared when that amazing destination wedding opportunity comes up

You'll have the confidence to expand your business across state lines as you grow

Why turn down work or stress over last-minute research when you could reference this workshop anytime.

-

Most CPAs are generalists who work with dozens of business types. I've had countless photographers tell me their accountants gave them incorrect sales tax advice because they simply don't specialize in photography.

While they understand general tax principles, very few have researched the specific sales tax treatment for photographers' services and digital products across all states.

This workshop gives you information most general accountants don't have, allowing you to either handle sales tax correctly yourself or guide your accountant with industry-specific requirements.

-

Actually, this is PERFECT for new photographers!

Many established photographers tell me their biggest regret is not understanding sales tax from day one. They spent years fixing mistakes that could have been avoided.

Starting with proper sales tax practices helps you:

Build client relationships based on transparent pricing

Create systems that scale as you grow

Avoid the stress of catching up on compliance later

It's always easier to start right than fix mistakes!

-

The financial hit can be devastating: back taxes, penalties, interest that compounds daily, and audit expenses.

Real example: A wedding photographer I worked with faced a $7,842 tax bill after just three years of incorrect sales tax handling.

But beyond money, there's the constant stress of uncertainty—wondering if you're doing things correctly and feeling like your business isn't fully legitimate.

Get the workshop so you can eliminate that uncertainty and focus on what you do best: creating beautiful images for your clients.

45 Minutes to Solve Your Sales Tax Confusion Today

Everything you need to get sales tax right, without the overwhelm.

Hey there, Photographer!

I can’t wait for you to feel the peace of mind that comes from finally understanding how sales tax works in your photography business. When you know exactly how to register, what to charge, and how to track and pay it correctly, something incredible happens — your creativity has room to breathe again.

You stop second-guessing every invoice.

You stop wondering if you “missed something.”

And you start focusing on creating the beautiful work your clients love you for.

I created this workshop because I’ve watched too many talented photographers get blindsided by sales tax… not because they weren’t doing their best, but because no one ever explained it in a way that actually made sense. You deserve straightforward steps, calm clarity, and a process that supports the business you’ve worked so damn hard to build.

And I want you to know this — when you jump in, you’re joining thousands of photographers who’ve traded confusion for confidence. I’ll be over here doing my ridiculous happy dance the moment I see your order come through, because I know what’s waiting for you on the other side of this.

This workshop represents my commitment to helping you run a business that supports your life, your art, and your goals — without the financial chaos or tax anxiety.

I’m truly honored to be part of your photography journey.

With you every step of the way,